Working with chargebacks is an important process for any business that accepts card payments. Mistakes at this stage can be costly: loss of money, deterioration of reputation, and even problems with payment systems.

What is a chargeback and why is it important?

A chargeback is a refund of funds for a transaction initiated by the issuing bank at the request of the cardholder. Most often, a chargeback occurs if the customer is dissatisfied with the product or service, believes that the transaction was carried out fraudulently, or if technical problems arise.

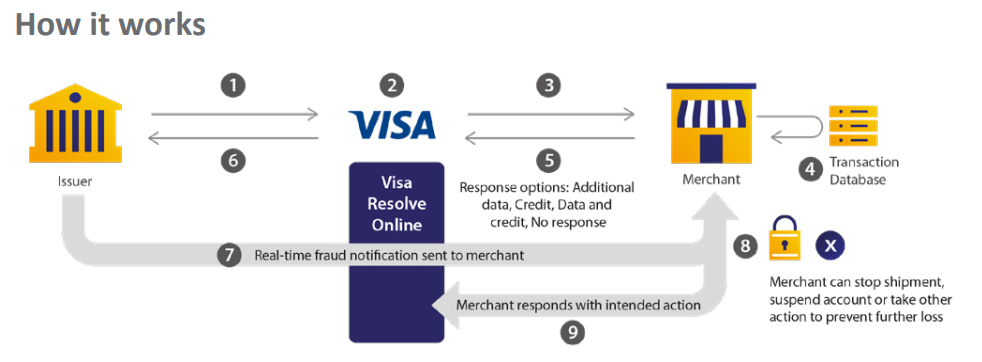

The chargeback process in the Visa system (or any other) looks the same: the client sends a request to his bank, the bank checks the validity of the claim, and then interacts with the acquiring bank and the seller. If you don’t know how to work with this process correctly, your chances of getting your money back and keeping your income are minimal.

Visa chargeback is not just an “inconvenient request”, but it is a full-fledged system with rules, deadlines and nuances. Neglecting them can lead to financial losses and complications in working with banks.

The main mistakes when working with chargebacks

Mistakes in working with chargebacks are often associated with a lack of knowledge or an incorrect approach to this process. Here are the most common ones:

- Ignoring the response time. Each stage of working with chargeback has strictly set deadlines. If you are late in providing documents or explanations, the decision will automatically be made in favor of the client. For example, according to Visa rules, the seller must provide a response within 30 days of receiving the request.

- Insufficient documentation. Many companies do not store all the necessary transaction data, which complicates protection in the event of a dispute. For example, you need to save: receipts and payment confirmations, correspondence with the customer, proof of delivery of goods or provision of services. Without these documents, it will be difficult for you to prove that the service was provided in full.

- Ignoring customer complaints at an early stage. Chargebacks often start with a simple customer dissatisfaction. If the problem is ignored at this stage, the customer will most likely contact the bank. By solving the problem directly, you will not only save money, but also maintain customer loyalty.

- Incorrect presentation of evidence. When a dispute arises, you must provide not just a lot of documents, but relevant evidence. If the documents are not structured, incomplete, or do not match the request, the probability of winning the dispute is minimal.

How to avoid mistakes?

Working with chargebacks requires attention and clear organization. To reduce risks, it is important to implement the right approach. Here are some recommendations:

- Control the deadlines. Immediately after receiving the request from the bank, start preparing a response. Create a reminder system so that you don’t miss anything.

- Keep a complete record of the data.. Store all information about transactions and customer interactions. This will help you quickly collect the necessary documents in case of a chargeback.

- Train the staff. Make sure that employees know how to respond to customer complaints, which documents are important for working with chargebacks, and how to quickly prepare a response.

- Use fraud prevention tools. Many chargebacks are associated with fraudulent transactions. Connect suspicious transaction analysis systems to identify risks in advance.

- Check the client information. Make sure that the customer’s contact details are correct to avoid misunderstandings when delivering goods or providing services.

Avoiding chargebacks is easier than dealing with their consequences. Building transparent and trusting relationships with customers, using reliable transaction analysis tools and document control help minimize risks.